We do not request reimbursement of costs

(such as repayment for obtaining medical records)

from veterans nor from people who suffer from multiple sclerosis.

- Call today for a free evaluation

- 1-888-774-7243

Social Security Benefits Increase In 2023: Quick Facts

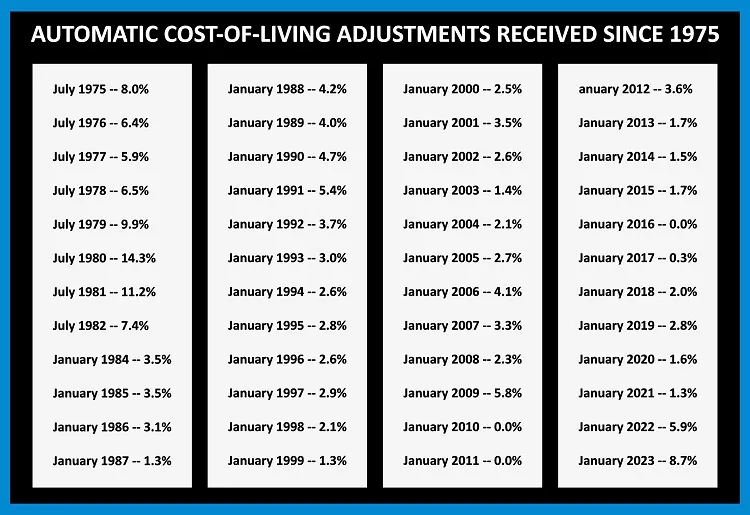

Senior citizens and millions of recipients of Social Security in the United States will receive their most significant benefit raise since 1981. The pension program is set to deliver an 8.7% Cost-of-Living Adjustment (COLA) increase in 2023.

What Are The Significant Changes To Social Security Benefits in 2023?

There are approximately 70 million Americans who depend on one of the Social Security programs, so there are modifications to the benefits programs each year. Moreover, 2023 will see the biggest increase in benefits since 1981.

The following are some of the adjustments that the Social Security Administration has outlined for 2023:

- There will be an increase in Cost of Living Adjustment (COLA)

- Taxable earnings will go up

- Social Security benefits will increase

There Will Be An Increase In The Cost of Living Adjustment (COLA).

The Social Security Administration (SSA) will show an increase from 5.9% in 2022 to 8.7% in 2023, amounting to a $146 enhancement in the monthly benefits for the retired worker.

The benefits will begin in January of 2023 and increase from $1,681 to $1,827. For the couple, the average rise will be $238, going from $2,734 to $2,972.

Previously, the Social Security Administration (SSA) had tied the COLA to the CPI-W (Consumer Price Index for urban workers and clerical workers). To determine the COLA, the SSA will compare the prior year’s third quarter CPI-W to the current year’s third quarter CPI-W. The adjustment of COLA is then made based on the difference between these two CPI-Ws.

Taxable Earnings Will Go Up

In 2023, the maximum earnings will increase from $147,000 in 2022 to $160,200. Moreover, it also means that the higher the income, the more tax will be applied. The adjustment is based on the average wages in America.

Social Security Benefits Will Be Increased

The Social Security Disability benefits in 2023 will increase for a worker retiring at the full retirement age to $3,627 from $3,345. Furthermore, the maximum retirement age will be 67 for individuals born after 1960. However, the benefits will reduce if an individual does not reach their full retirement age.

What Are The Benefits For Disabled Workers And Their Spouses?

Disabled workers and their spouses, who are receiving Social Security disability benefits, will benefit from an increase in 2023. This will help them to cope with their increased medical expenses as well as other costs.

The following chart breakdowns the increases for disabled workers and their spouses in 2023:

| Beneficiaries | Sizable benefits increase |

|---|---|

| Widowed mother with two children | From $3,238 to $ 3,520 |

| Aging widows and widowers residing alone | From $1,567 to $ 1,704 |

| A disabled worker having one or more children and a spouse | From $2,407 to $ 2,616 |

Source: https://www.sssamiti.org/social-security-cola-2023/

However, the amount may differ based on the individual’s unique situation.

The Increase In The Disability Rate In 2023

The 2023 COLA will increase the average monthly Social Security Disability Insurance (SSDI) benefit for a disabled worker by $119, from $1,364 to $1,483, according to the SSA.

The following groups of individuals also receive higher benefits

| Category | Average Monthly Increase | Average 2023 check |

|---|---|---|

| Retiree | $146 | $1,827 |

| Worker with disabilities | $119 | $1,483 |

| Senior couple, both receiving benefits | $238 | $2,972 |

| Widow/Widower | $137 | $1,704 |

| Widow/Widower having 2 children | $282 | $3,520 |

Will The Medicare Premiums Be Lowered In 2023?

The standard monthly Medicare Part B premium will amount to $164.90 in 2023, a decrease of $5.20 from 2022. However, if we talk about the annual deductible, it will be $226 in 2023, down from $233 in 2022.

Why Is Social Security Increasing?

Social Security is increasing in 2023 to ensure that those receiving benefits, such as retired workers or disabled individuals, keep up with the rising cost of living. It is an important part of the government’s commitment to providing financial security for those who depend on Social Security benefits.

The increase in the COLA also helps to ensure that the Social Security program remains sustainable for current and future generations. The COLA is based on the CPI-W index, which measures changes in consumer prices and is used to adjust benefits each year. The increase in the COLA is intended to ensure that beneficiaries can keep up with the rising cost of living. This measure will take effect for social security beneficiaries in January 2023.

How Will You Determine If You Are Eligible To Receive The Benefit Increase In 2023?

The SSA will be providing notices to all eligible individuals. Individuals who are eligible for benefits can also check their eligibility for the increase by visiting Social Security’s website and using their My Social Security account. This will provide information on how much any increase in benefits will be.

To get a clear understanding of the advantages you will receive, feel free to compute it yourself. For instance, simply multiply your net Social Security benefit by 8.7%, which is the established cost-of-living adjustment for 2023. This way, you’ll have an accurate idea of how much extra cash you can expect in 2023!

Furthermore, a Social Security Disability Lawyer can also help you understand the SSI disability increase in 2023. Secondly, they can also aid with the Social Security application process, ensuring that your claim is received in a timely manner. Schedule a free case consultation with our new jersey disability law firm if you still have any questions.

FAQs for SSI Increase 2023

What do retirees need to know about Social Security’s Cost of Living Adjustment (COLA) in 2023?

Although the COLA will increase by 8.7% in 2023, retirees may still be uncertain about how much of an increase they will receive. In December, retirees received a COLA notice giving them details of their updated benefits for the coming year. Furthermore, retirees will owe income tax on their aid in 2024.

Will everyone get an 8.7% increase in COLA in 2023?

It may vary depending on your situation; many will receive an 8.7% increase in benefits, while others may receive a smaller increase or even no change at all. This is because there will be a decrease in Medicare Part B premiums in 2023, resulting in a deduction from Social Security payments.

For a Free Evaluation

Monday : 9am–5pm

Tuesday : 9am–5pm

Wednesday : 9am–5pm

Thursday : 9am–5pm

Friday : 9am–5pm

Saturday : Closed

Sunday :Closed